It is not widely known and understood by many companies whether VAT is due on water services.

Let us help clarify.

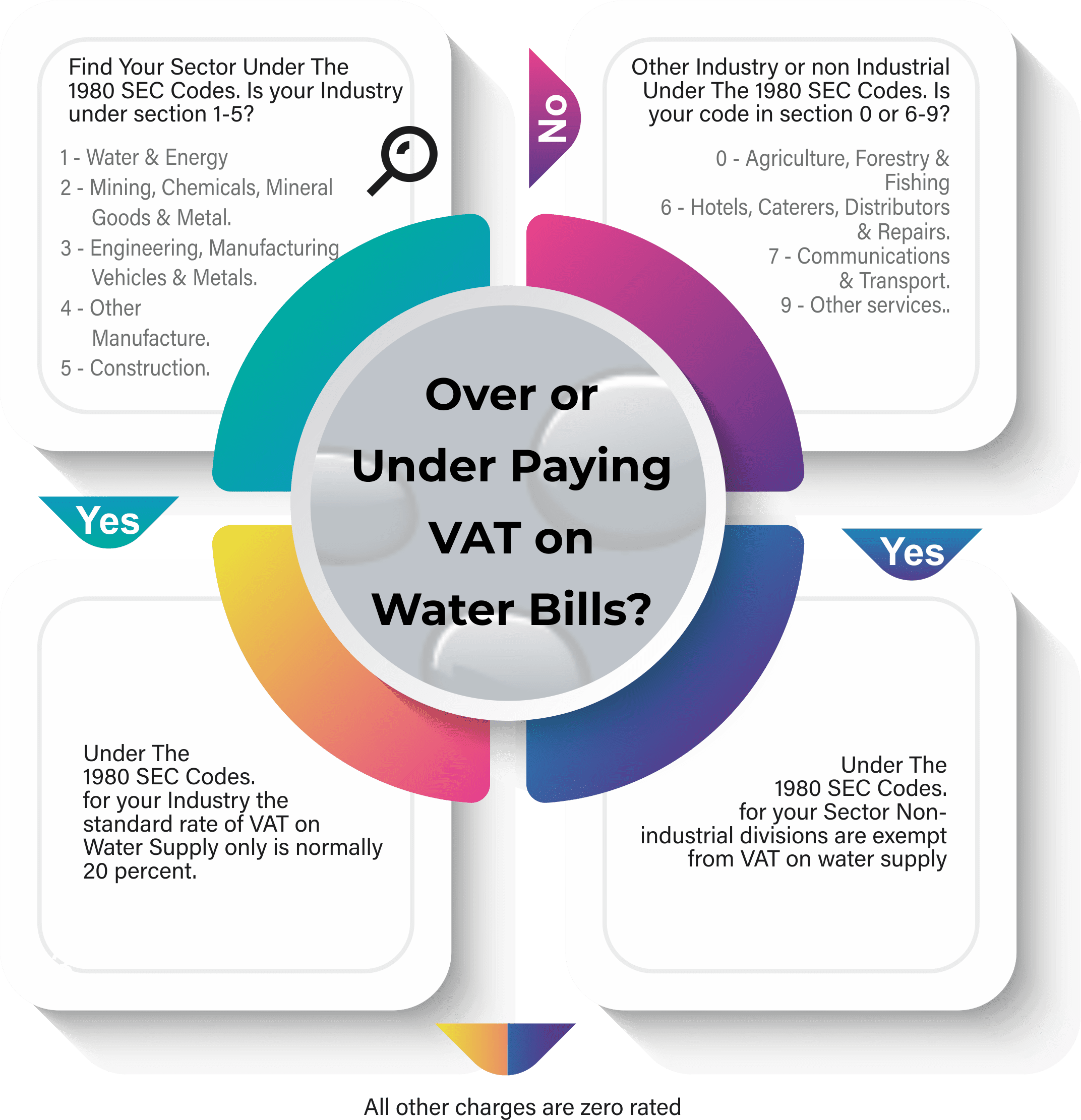

To ensure that you are avoiding unnecessary VAT charges you should consult the 1980 Standard Industrial Classification or SIC codes.

If you are categorised in Sections 1-5, you are obliged to pay VAT on the water supply element of your invoice.

The divisions are very broadly outlined as:

1: Industries of Water and Energy supplies.

2: Industries of Extraction of non-fuel ores. Manufacture of chemicals, mineral goods and metal.

3: Industries of Engineering, Manufacture of vehicles and metals not already specified elsewhere.

4: Industries of Other manufacturing.

5: Industry of Construction.

Non-industrial divisions are exempt from VAT on water supply such as:

0: Industries of Agriculture, Forestry and Fishing

6: Hotels, Caterers, Distributors and Repairs.

7: Communications and Transport.

9: Other services.

In very general terms the first 5 Divisions involve commercial enterprises where water is part of the business process, and not just a commodity for drinking and hygiene.

The main business activity of your industry was defined into various codes by the Office of National Statistics and for the water industry the current VAT rules apply to the 1980 SIC codes edition.

In 2007 the codes were updated to a 5-digit number however the HMRC has kept the 1980 3-digit Standard Industrial Classification activity codes as a means of identifying the rates of VAT relative to the industries defined.

What is the current rate of VAT on Water Supply and Wastewater?

- The standard rate of VAT on Water Supply is 20 percent.

- VAT on Wastewater and Drainage services are Zero Rated.

If you think you should be paying VAT on your water invoice, let us know here and we will help clarify.